Infrastructure, Timelines, and Delivery Readiness

Libya’s natural gas sector is entering a period in which several long-planned gas projects are approaching delivery milestones. While oil production remains the primary focus of sector reporting, developments across the Libya gas sector are increasingly relevant to domestic energy supply and gas exports, particularly as new upstream gas projects move closer to commissioning.

Industry disclosures and company reporting indicate that 2026 represents a key reference point for Libya gas projects, with upstream developments, energy infrastructure, and export systems expected to play a greater role in shaping operational outcomes. This article reviews the principal gas developments and infrastructure assets expected to influence gas production in Libya through 2026, based on publicly available and verifiable sources.

Libya’s Western Gas System

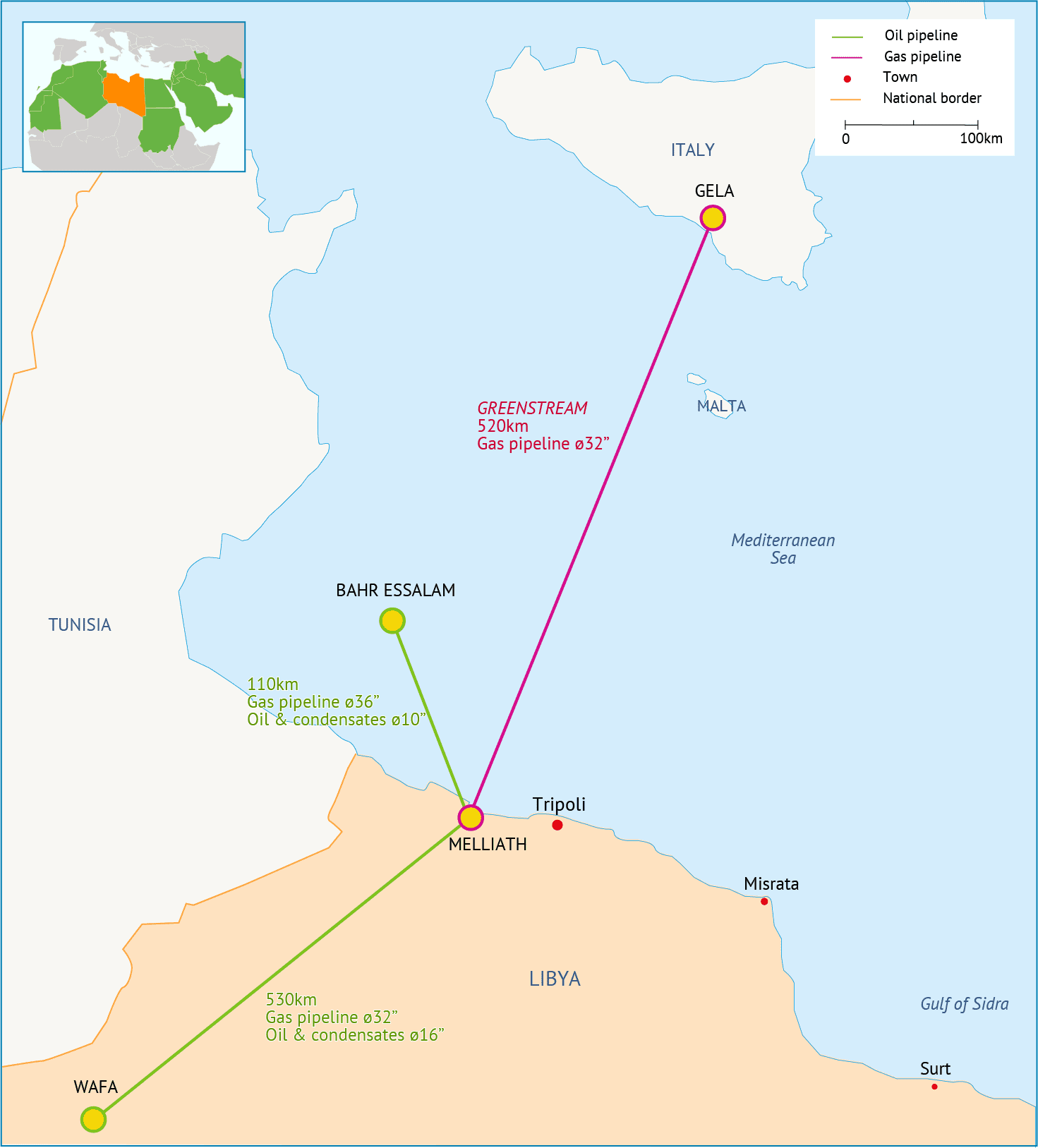

Libya’s gas production and export framework is concentrated around the western gas corridor, anchored by the Mellitah Oil & Gas complex. According to Eni, natural gas produced from the Wafa onshore field and the Bahr Essalam offshore field is processed at Mellitah before being supplied to domestic markets or exported via the Greenstream pipeline to Italy.

This configuration means that performance across the Libya energy sector depends not only on upstream gas supply, but also on the availability and reliability of gas processing, compression, and export infrastructure. As a result, developments across the full gas system must be considered when assessing delivery readiness for 2026.

Structures A & E: Flagship Gas Project

The most significant gas development expected to influence Libya gas production in 2026 is the offshore Structures A & E project. Operated through the Mellitah Oil & Gas joint venture between the National Oil Corporation and Eni, the project involves the development of two offshore gas structures tied back to existing onshore processing facilities.

Eni has stated that combined gas production from Structures A & E is scheduled to start in 2026, with the project expected to reach a plateau production level of approximately 750 million standard cubic feet per day. Eni’s Libya operations overview and multiple industry sources also position the project’s start-up within the 2026 timeframe, with some references indicating end of 2026 timing.

If delivered as planned, Structures A & E would represent the most material addition to natural gas Libya has seen in recent years, supporting both domestic supply and Libya gas exports.

Processing and Compression at Mellitah

The Mellitah Oil & Gas complex plays a central role in determining how effectively new gas volumes can be delivered. Gas from upstream fields is treated, compressed, and routed at Mellitah before entering domestic supply networks or the Greenstream export system.

As Structures A & E is designed to tie into existing Mellitah infrastructure, the condition, capacity utilisation, and maintenance of the complex remain critical factors. Industry reporting has highlighted that maintenance activity or unplanned outages at Mellitah can directly affect Libya gas exports, underlining the importance of operational reliability at the hub.

Bahr Essalam and the Sabratha Compression Project

Alongside new upstream gas developments, sustaining deliverability from existing fields remains a priority. The Bahr Essalam offshore field is a key supply source feeding the Mellitah complex and the Greenstream pipeline.

In 2025, the National Oil Corporation announced the implementation of a major gas compression project at Bahr Essalam. According to official statements, the compression module was installed on the Sabratha platform as part of efforts to sustain gas production in Libya and improve operational efficiency. Reporting indicates that the compression unit has a capacity of up to 100 million cubic feet of raw gas per day and entered its operational phase in October 2025.

These upgrades represent enabling energy infrastructure, supporting both existing gas output and the integration of new upstream gas projects.

Greenstream Export Pipeline

Greenstream remains Libya’s primary gas export route to Europe. According to Greenstream BV, the pipeline system is jointly owned by Eni North Africa BV and the National Oil Corporation and consists of a gas compression station at Mellitah, an offshore pipeline of approximately 510 kilometres, and a receiving terminal in Gela, Sicily.

While no major expansion of the Greenstream pipeline has been publicly announced for 2026, its continued availability remains a key factor in determining Libya gas exports. Industry reporting indicates that export flows through Greenstream are sensitive to maintenance activity and upstream gas availability, reinforcing the system’s reliance on hub reliability rather than additional pipeline capacity.

Additional Gas Developments to Monitor

In addition to Structures A & E, Eni has identified the Bouri Gas Utilisation Project as one of three gas-related projects sanctioned in 2023 and under progress review during 2025. While detailed commissioning timelines are not consistently disclosed, multiple sources reference 2026 as a period during which progress or start-up milestones may occur.

Separately, industry reporting indicates that international operators are planning deepwater exploration drilling targeting gas prospects in early 2026, reflecting renewed upstream activity that could influence longer-term gas production in Libya beyond the immediate outlook period.

What to Expect in 2026

Based on current disclosures and industry reporting, several evidence-based observations can be made regarding Libya gas projects in 2026:

- Structures A & E is the most clearly defined new source of gas production in Libya expected to begin in 2026, with a stated plateau of 750 million standard cubic feet per day.

- Effective delivery of new gas volumes depends on the reliability of gas processing and compression infrastructure at Mellitah.

- Compression upgrades at Bahr Essalam support system stability ahead of new upstream gas integration.

- Greenstream remains the primary export infrastructure, with Libya gas exports linked to operational continuity rather than new capacity additions.

These expectations reflect reported plans and infrastructure readiness rather than guaranteed outcomes.

Conclusion

Libya’s gas sector outlook for 2026 is shaped by a small number of high-impact gas projects and infrastructure systems. The anticipated start-up of Structures A & E, supported by compression upgrades at Bahr Essalam and the continued operation of Mellitah and the Greenstream pipeline, forms the core of current gas development expectations.

For industry stakeholders, monitoring project execution, maintenance activity, and infrastructure reliability will remain central to assessing how natural gas Libya production and exports evolve through 2026.A detailed analysis of Libya gas projects, infrastructure assets, and delivery timelines for 2026 is available in the full report: